Investors and operating companies who are broadening portfolios via acquisitions and joint ventures and are resource constrained by a lack of experienced business, technical and market-savvy resources will find CAP Resources invaluable in assessing both opportunities and risks associated with such ventures, and efficiently executing deals. Investor companies experiencing short-term project needs due to internal resource constraints can augment their due diligence resources through CAP Resources.

CAP Resources works with professional investment groups to keep a balance between deal flow, technology vetting, due diligence, guidance and growth of portfolio companies, and achieving exit strategies. With over $3 Billion in transaction support under our belt, we appreciate the fine line between recognizing investment opportunities and understanding the realities and pitfalls of often unproven services and technologies.

We also do “deep dives” into specific technical fields and business services and can generate deal flow, profile target technology companies, and prioritize investment opportunities for consideration. We frequently act as a facilitator to support investment objectives, keep all aspects of transactions on track, and make sure that targets are preferentially pre-disposed to working with our clients over other potential investors.

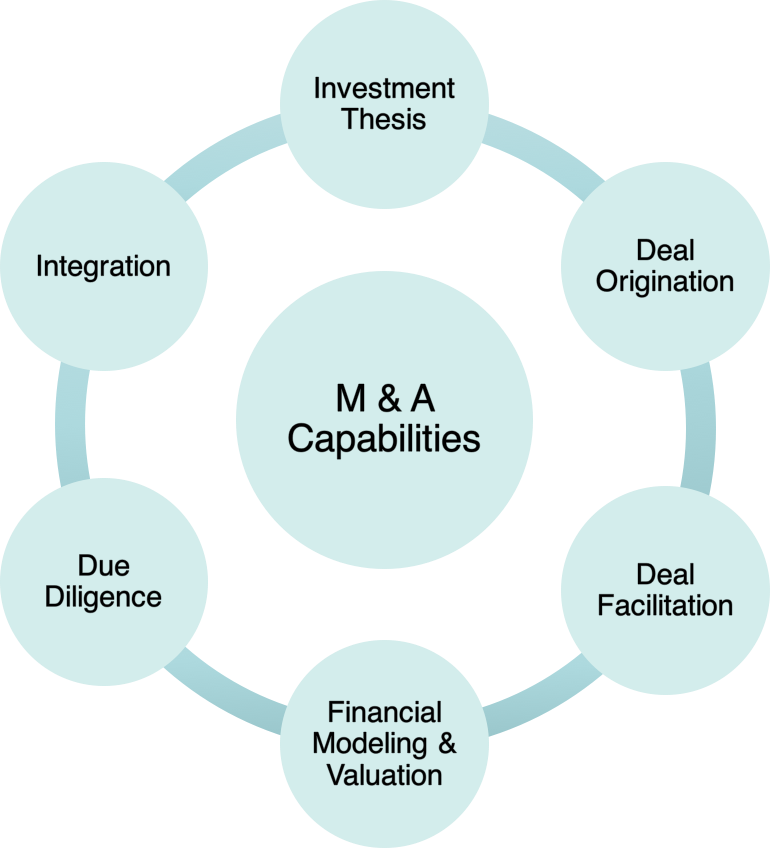

Whether you need help from the initial stages of assessing the target market and creating an investment thesis or mid way through the process with financial modeling and company valuation, CAP Resources is ready to engage at any point of the deal cycle.